If you’ve ever bought a home, you’ll be well aware of stamp duty. Stamp duty can be a significant expense for home buyers. And one that often catches first home buyers off guard.

Luckily, here in Queensland, concessions are in place for first home buyers. This has made a huge difference for some buyers to be able to get into their first homes.

But now there is talk about a stamp duty shake up. The proposed stamp duty changes from the Liberal National Party (LNP) include a review of the existing concession and lifting the thresholds.

Let’s take a closer look at how these potential stamp duty changes would impact buyers and sellers.

In this article – Stamp Duty Changes in Queensland: What You Need to Know

Key Takeaways

- Stamp duty is a state tax paid when purchasing a property, with Queensland offering concessions for first home buyers.

- Rising home prices have led to a decrease in stamp duty concession uptake, contributing to Queensland having the lowest homeownership rate in Australia.

- The Liberal National Party (LNP) proposes reviewing and increasing stamp duty concession thresholds to support first home buyers and address declining home ownership rates.

- Potential changes to stamp duty concessions could significantly benefit first home buyers and improve overall home ownership rates.

What is stamp duty?

Stamp duty is a state (or territory) tax that is paid when someone buys a property. Because it’s managed by each state, the thresholds, rates and exemptions are different across the country.

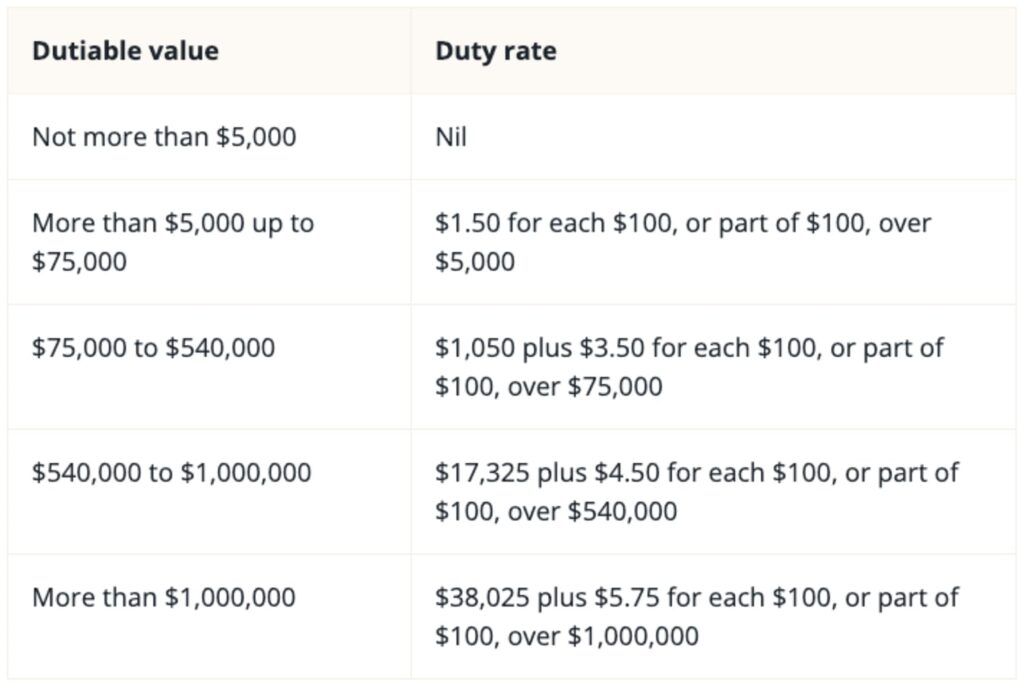

In Queensland you might hear stamp duty referred to as ‘transfer duty rates’ and the rates are as set out in the table below. You can also use the Revenue Office’s online estimator to figure out the amount of stamp duty you might owe on a property purchase.

Source: Queensland Revenue Office

The funds raised from stamp duty are typically funnelled into the government budget within your state or territory. This of course helps to pay for vital things like transport and health.

Queensland stamp duty concessions

Of course, there are concessions given in certain circumstances, which can give buyers relief from paying the full stamp duty. These home concession rates can apply if you’re buying your first home, for example, or your first purchase of a vacant plot of land which you’ll be using to buy your first home.

In Queensland, the stamp duty concession is designed to support first home buyers to purchase their first home. Currently this means they pay no stamp duty for properties valued up to $500,000.00, and a concession rate for properties valued between $500,001 and $549,999.

What are the proposed stamp duty changes for Queensland?

While stamp duty concessions are designed to support first home buyers to buy a home, and increase home ownership across our state, that doesn’t seem to be working.

Shadow Minister for Home Ownership David Janetzki recently stated that the number of first home buyer stamp duty concessions has significantly reduced in areas across Queensland. These include Brisbane, Ipswich, Logan, Beaudesert and Moreton Bay over the past 12 months. He added that they dropped by 40% in Brisbane East and the Redlands last year, and by 75% since the 2014-15 financial year.

It seems that people aren’t able to take advantage of the concessions, because home prices have skyrocketed. And this is negatively impacted first home buyers in particular and has potentially affected the home ownership rates in our state.

Some experts believe that the stamp duty concessions have not kept up to date with the median cost of properties in Queensland. And that because of that the threshold should be raised.

In fact, Queensland has the lowest rate of home ownership in the country. The Australian Bureau of Statistics put home ownership levels at 63.5% in Queensland after the 2021 Census.

Janetzki said the LNP hopes to ‘make Queensland top of the pile for home ownership in this country’. He added: ‘If a young person aspires to attain home ownership, they should have an opportunity to achieve it.’

To help combat this problem, the LNP has announced its plans to review the stamp duty concession threshold ahead of the upcoming state election.

Understanding the impacts of potential stamp duty changes

While we don’t know exactly what changes might be coming through the pipeline, there is the potential for more concessions in the future. This will help both buyers and sellers to be in a better position to move on property transfers. And it may help home ownership overall.

How Victor Legal can help you navigate stamp duty changes

The Victor Legal team always has its finger on the pulse. As experienced conveyancing lawyers, we ensure we are always up to date with the latest stamp duty regulations. That means you are too. Whether you are buying or selling a home, let Victor Legal take the stress out of the process. Get in touch today.